how to calculate sales tax in oklahoma

Sales Tax 50000 -. If youve opened this page and reading this chances are you are living in Oklahoma and you intend to know the sales tax rate right.

South Carolina Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

Simplify Oklahoma sales tax compliance.

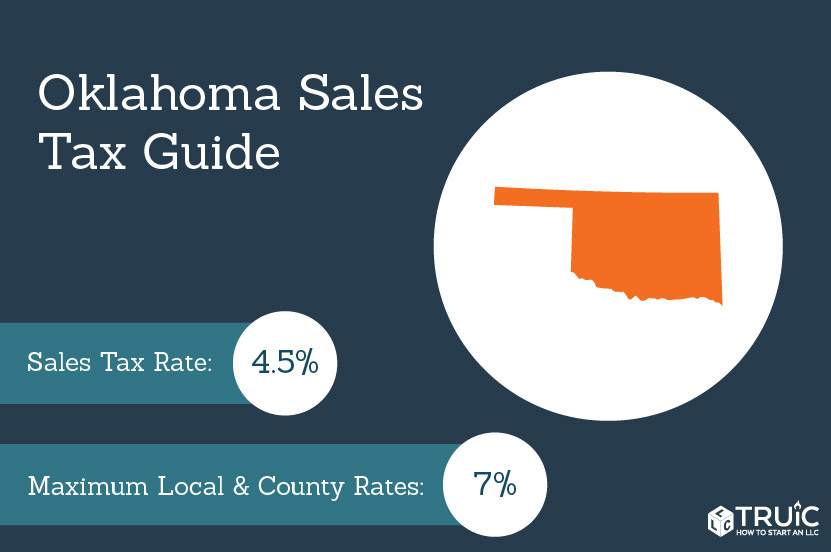

. The base state sales tax rate in Oklahoma is 45. The Oklahoma state sales tax rate is 45. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

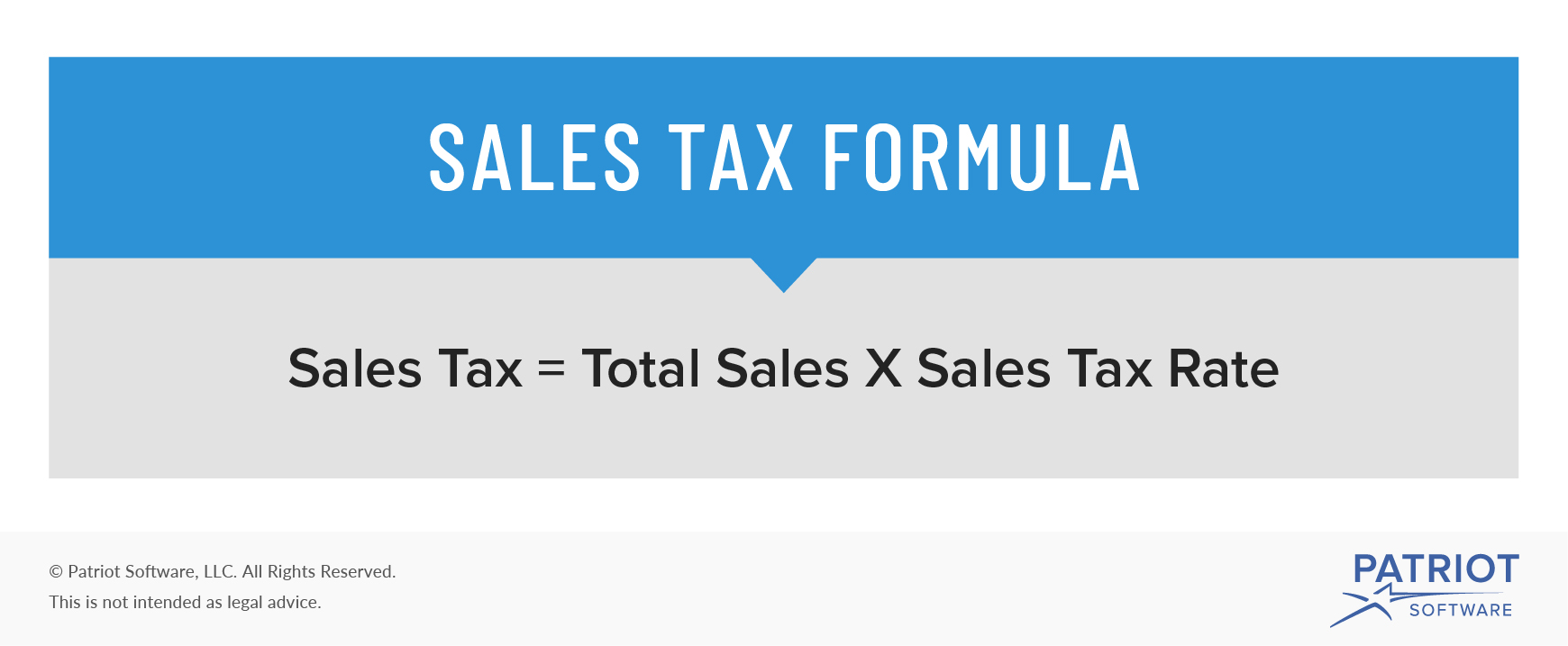

How to Compare Sales Tax in Owasso Oklahoma. You can calculate Sales Tax manually using the formula or use the Tulsa Sales Tax Calculator or compare Sales Tax between different locations within Oklahoma. 325 of taxable value which decreases by 35 annually.

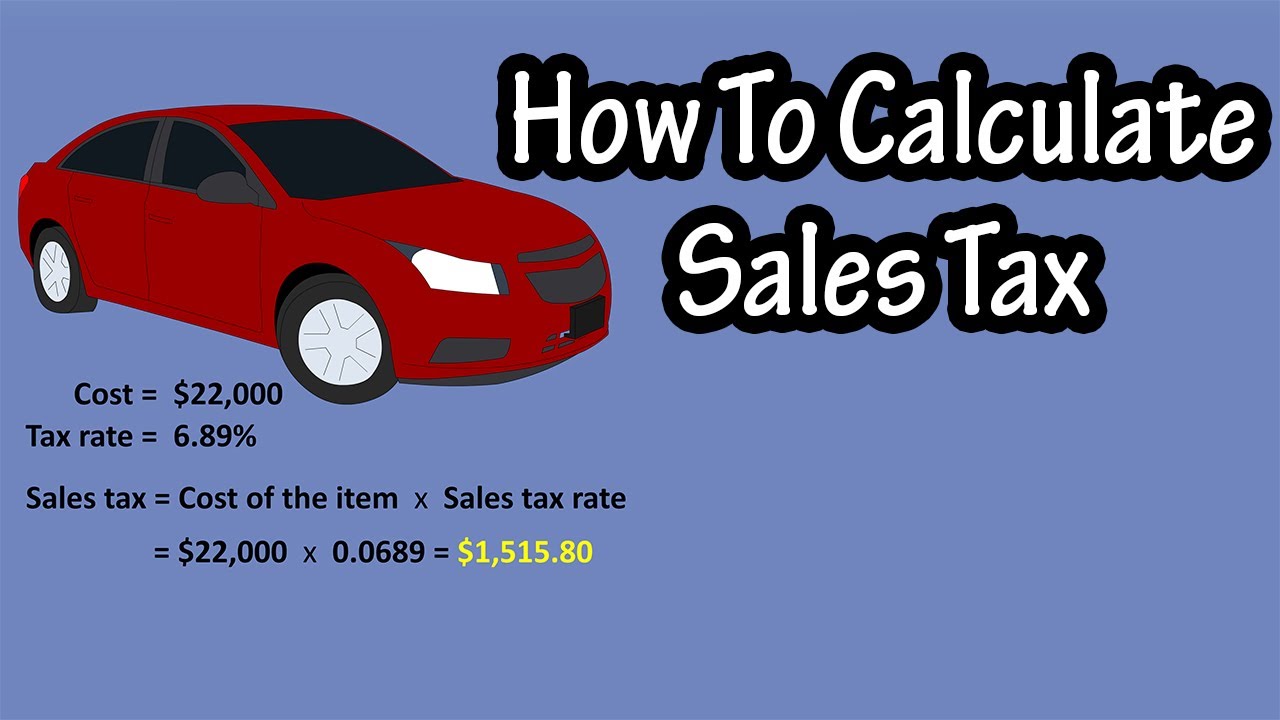

To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Oklahoma charges two taxes for the purchase of new motor vehicles. Typically the tax is determined by the purchase price of.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale. Sales tax in edmond oklahoma is calculated using the following formula.

Used vehicles are taxed a flat fee of 20 on. Choose Avalara sales tax rate tables by state or look up individual rates by address. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is.

Just enter the five-digit zip. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. We provide sales tax rate databases for businesses who manage their own sales.

The state general sales tax rate of oklahoma is 45. Find your Oklahoma combined. 2022 Oklahoma state sales tax.

Oklahoma Sales Tax Table at 82 - Prices from 42220 to 46900. The Oklahoma OK state sales tax rate is currently 45. Most transactions of goods or services between businesses are not subject to.

If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to. 125 sales tax and 325 excise tax for a total 45 tax rate. As a business owner selling taxable goods or services.

Typically the tax is determined by. Depending on local municipalities the total tax rate can be as high as 115. Calculate Sales Tax in Oklahoma Example New Car Initial Car Price.

Exact tax amount may vary for different items. The following step-by-step guide covers the process required to compare Sales Tax using the US Sales Tax Comparison Calculator. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

325 of ½ the actual purchase pricecurrent value. 19 cents per gallon of regular gasoline and. Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242.

Oklahoma State Tax Quick Facts. Other local-level tax rates in the state of Oklahoma are. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Choose Avalara sales tax rate tables by state or look up individual rates by address. After a few seconds you will be provided with a full breakdown.

087 average effective rate. Sales Tax Rate s c l sr. Oklahoma Sales Tax Rates.

54 rows Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

Hitch It Trailer Sales Trailer Parts Service Truck Accessories Trailers For Sale Aqua Lily Pad Lily Pads

Oklahoma Sales Tax Small Business Guide Truic

2x Thayers Facial Toner Rose Petal Unscented Witch Hazel W Aloe Vera 12oz Ebay In 2022 Facial Toner Unscented Aloe Vera

How To Calculate Sales Tax Definition Formula Example

What Does Property Manager Do Property Management Management Company Management

Cocokind Vitamin C Serum With Sea Grape Caviar 1 Fl Oz In 2022 Vitamin C Serum Vitamins Serum

Checklist For Becoming A Free Business Consultation Coaching Business Consulting Business Consulting

Stripe Understanding Us Sales Tax And Economic Nexus A Guide For Startups

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube

How To Calculate Sales Tax A Simple Guide Bench Accounting

Free Sample Cash Flow Forecast Template Cash Flow Cash Flow Statement Business Plan Template Free

Pin By Steeler Of The Day Dan Kreider On Aafc 1946 1949 Game Artwork Video Game Covers Video Games Artwork

How To Calculate Sales Tax For Your Online Store

How To Charge Your Customers The Correct Sales Tax Rates

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation